Last Updated on January 21, 2025

This guide will share everything you need to know about tax if you are a non-resident who is considering investing in German real estate.

Germany, with its stable economy and robust real estate market, has become an increasingly attractive destination for international investors.

However, the management of German property tax requirements can often act as a deterrent to investors.

After all, it can be hard to come to terms with German tax law, especially if you don’t speak the local language.

As with any investment, understanding and navigating the tax implications is crucial for optimizing returns and avoiding unforeseen challenges.

This comprehensive guide serves as a valuable resource for making tax-savvy decisions if you are a non-resident who is considering investing in German real estate.

#1 Do not do your taxes on your own

Navigating the complexities of German tax law, especially as a foreign investor, can be daunting. While various tax reliefs exist for real estate investors, maximizing them requires a deep understanding of the system.

Don’t go it alone:

Instead of struggling through unfamiliar regulations, let an experienced German property tax advisor guide you. They can:

- Identify all applicable tax reliefs: Discover the full range of deductions and exemptions you qualify for, potentially saving you significant sums.

- Ensure compliance: Avoid the risk of errors and penalties by having a property tax professional navigate the intricacies of German tax law.

- Minimize paperwork and stress: Focus on your investment strategy while your tax advisor handles the complex tax filings.

Invest in expert advice:

Consulting a qualified tax advisor can unlock hidden tax savings, simplify your experience, and give you peace of mind knowing you’re maximizing your returns.

#2 Get a clear idea of the income that you need to declare

You should be aware of the income that you need to declare. The main source of your income will likely come from rent.

However, it’s also important to disclose any other sources of income, such as insurance payouts for example.

For ideas about how to get your documents organized and more, review our property tax tips.

#3 Claim all your allowable expenses

Property investors are eligible for a variety of tax breaks, and knowing about them ahead of time might save you a lot of money.

You can take advantage of several attractive tax perks if you opt to rent your property in Germany.

The tax system allows landlords to deduct expenses incurred in generating rental income (such as mortgage interest, repairs, and maintenance) from any rental income received. These deductions are available through your annual income tax return.

Management fees, insurance, tenant advertising, council rates, gardening charges, and reasonable travel expenditures to examine the property can all be claimed, but it’s best to consult your property tax expert for a complete list that is valid for your situation.

It’s also important to be aware of the expenses that you can’t claim – such as expenses paid by the tenants, as well as expenses incurred from your personal use of the property.

If you are a non-resident property owner in Germany, our tax experts can take care of your annual tax filing requirement and claim all allowable expenses.

#4 Check if you are exempt from Capital Gains Tax

If you sell your real estate at a higher price than it was bought for, the profit is known as Capital Gains and is considered taxable income in Germany.

Non-resident foreigners are only taxed on income earned in Germany.

If you sell a property that you’ve owned for less than ten years, you’ll have to pay Capital Gains tax on the profit you make.

Individual income tax in Germany is levied at progressive rates.

In Capital Gains Tax in Germany from the sale of rental property is taxed at the same rate as the income tax.

There are certain exceptions to the German Capital Gains tax and that’s the great news.

If you own your home and have lived there for at least two years, you will not have to pay Capital Gains tax when you sell it.

Furthermore, as mentioned above, any profit realized from the sale of a property after ten years of ownership is exempt from capital gains tax.

If you sell your home within ten years of buying it, your capital gains will be taxed at the usual progressive income tax rates, plus solidarity surcharges.

Here are the regular progressive income tax rates in Germany.

In 2024, residents can earn up to €11,604 without paying taxes, which is a significant increase from the 2023 limit of €10,908.

Note: Non-residents are always paying Income tax even if their income is below €11,604. The threshold for German residents is added to their profit.

|

Taxable Income (2024) |

Tax rate |

|

Less than €11,604 (the threshold for German residents) |

0% |

|

€11,604 – €66,760 |

14% to 42% |

|

€66,760 – €277,825 |

42% |

|

over €277,825 |

45% |

Want to learn about our online capital gains tax return filing service?

When you apply through this contact form a property tax professional will contact you.

#5 Understand the German property taxes

So, what taxes do you have to pay on your German buy-to-let real estate?

The good news is that the German property tax for non-residents is almost the same as for residents.

Property taxes in Germany might be confusing, and they are separate from the fees you must pay when purchasing a home.

When purchasing real estate in Germany, various taxes may be incurred depending on the circumstances. Taxes are imposed at three levels: federal, state, and municipal.

As a result, there are differences in the regulations on each level, as well as differences in the basis of assessment and the amount of tax rates and contributions.

Here are some examples of real estate taxes:

- Real estate transfer tax (GrESt)

- Land tax (GrSt)

- Speculation tax

- Turnover tax (VAT) & Trade tax (GewSt)

- Gift tax (SchenkSt)

- Inheritance tax (ErbSt)

Let’s discuss some of the real estate taxes in Germany that you need to be aware of:

⬤ ⬤ ⬤

Property Transfer Tax

You must pay a property transfer tax, known in German as Grunderwerbsteuer, when you buy real estate in Germany.

The real estate transfer tax is a one-time, legal transaction tax that is levied when you purchase property or land.

It is imposed in the situation of a traditional purchase contract, as well as land exchanges, divisions, etc.

You will get a bill (called the Grunderwerbsteuerbescheid) from the federal state (Bundesland) in which the property is located within a month of your purchase being completed.

The tax rate is defined as a percentage of the purchase price and varies by state.

The tax rate varies between 3,5% and 6,5% of the property value in various states. The notary will not register the real estate purchase unless this tax is paid. The property transfer tax rate in Berlin for example is fixed at 6%.

Real Property Transfer Tax Rates in Germany:

3.5%: Bavaria

5.0%: Baden-Württemberg, Bremen, Niedersachsen, Rhineland-Palatinate, Saxony-Anhalt

5.5%: Hamburg, Saxony

6.0%: Berlin, Hessen, Mecklenburg-Vorpommern

6.5%: Brandenburg, North Rhine-Westphalia, Saarland, Schleswig-Holstein, Thuringia

⬤ ⬤ ⬤

German local property taxes

When researching the best locations to invest in Germany, pay attention to the rates of German local property taxes in the various regions.

In Germany, real estate is subject to this tax, and it’s called Grundsteuer.

It is a communal tax levied by each region’s municipal government. Rates differ from one region to another and are also determined by the type of property and its assessed value.

This tax is calculated annually but it’s paid to your local tax office (Finanzamt) every three months, and it is imposed on all property owners in Germany.

German Rental Revenue (German Income Tax)

Landlords’ rental income is taxed in Germany in the same way as regular income, with progressive rates. Any rental properties in Germany will be subject to income tax and will need to be declared every year with a fiscal report (known as a Steuererklärung für beschränkt Steuerpflichtige).

Applicable double taxation agreements (DTAs), which apply taxation rights between the investor’s country of residence and the country in which the income is generated (“source country,” in this case: Germany), frequently assign the right to tax income from immovable property to the source country.

You can, however, deduct some expenses from your rental revenue. For instance, mortgage interest rates, maintenance and repair expenses, German property tax, and real estate broker or accountant fees. The tax is also determined by the nature of the rental—whether it is long or short-term, if it is furnished, whether it is personally held or owned by a corporation, and so on.

Certain expenses, like maintenance costs, can be deducted from the gross yield. However, if maintenance costs surpass 15% of the home’s purchase price, they cannot be deducted in the year they were completed. Instead, these expenses will be added to the property’s depreciable value.

Depreciation on German real estate is 2% for existing houses and 3% for newly built homes for the first eight years.

Foreign investors’ tax liabilities include income from rental and leasing, which is taxed at their individual personal income tax rate.

PTI Returns can assist you in rental income tax return filing in Germany.

Our property tax advisors will calculate the amount of tax you owe on rental income (including the available deductions), so you don’t overpay.

Inheritance, Donation Tax

Inheritance and donation taxes are levied on real estate in Germany. The rate of taxation varies from 7% to 50%.

Non-German residents are generally subject to both inheritance and donation taxes on real estate located in Germany that is passed down through the family or given to a third party.

However, inheritance and donation taxes can be reduced by using tax exemptions.

#6 Make sure you keep all your records

Finally, the German tax office requires property investors to keep records such as their purchase contract, bank records, any capital gains tax documents, and evidence of any property improvement expenditures.

All of these documents contribute to the formation of your cost base and will very certainly be requested in the future. So that you don’t get any unpleasant surprises, keep them somewhere safe.

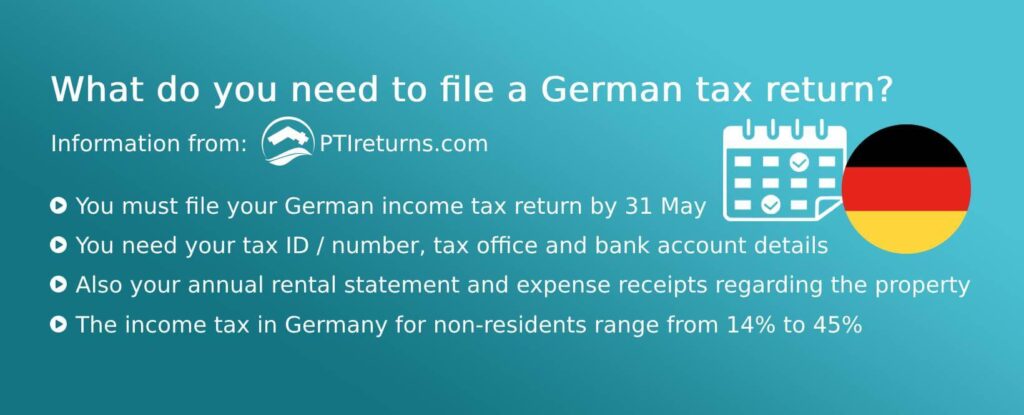

#7 Don’t miss the property tax filing deadlines in Germany

The tax deadline in Germany for the 2022 tax return is October 2, 2023 (without a tax advisor) and 31 July 2024 (if you apply with a tax advisor).

The German tax deadline for 2023, is 2 September 2024 (without a tax advisor) and 31 May 2025 (with a tax professional).

If you hire a tax advisor, the deadline is automatically extended until the end of February the following year.

Read also:

2024 Guide to Rental Income Tax in Germany

Who can help me file my German property tax return?

We know that dealing with the German tax authorities can be a daunting task.

But help is at hand! You don’t have to worry anymore about filing your German property tax return.

Property Tax International (PTI Returns) provides real estate tax specialist services and we can help you file your German property tax return online. We have 20+ years of experience preparing international tax returns on behalf of our customers.

PTI Returns specializes in German property tax and has unrivaled knowledge of the local tax system.

Why choose us?

- We will answer your questions

- Peace of Mind: Our tax experts will handle the complex German tax return filing and paperwork and communicate with the tax authorities on your behalf

- Our service is online – easy, fast, and reliable

For regular Tax Tips and deadline reminders, follow us on Linkedin or Facebook.