Last Updated on March 20, 2025

Did you know that if you are a foreigner and you own property in Spain but don’t live there, you might be on the hook for something called “non-resident tax in Spain”?

Do you rent out your property? Then, you must pay rental income tax in Spain.

Surprisingly, many property owners are unaware of their tax obligations and go years without paying them.

However, things have changed recently, and understanding the nuances of international property tax is crucial for global real estate investors.

The tax authorities have become more active in pursuing unpaid non-resident taxes in Spain. They’re now sending out tax demands to those who haven’t paid their dues for the past four years.

If you receive one of these demands, you’ll have just 10 days to make the payment.

And be prepared for some additional fines too, like interest on the unpaid amount and potential penalties down the line.

It’s better to stay on top of your non-resident tax responsibilities to avoid any surprises!

In this guide, you will find everything a non-resident landlord needs to know about property tax, rental income tax in Spain, and the tax filing deadlines.

Please note: PTI Returns provides tax return filing services to investors with property in Spain. We do not provide support services for mortgage applications or Spanish property purchases.

Non-resident tax in Spain

Do non-residents pay taxes in Spain?

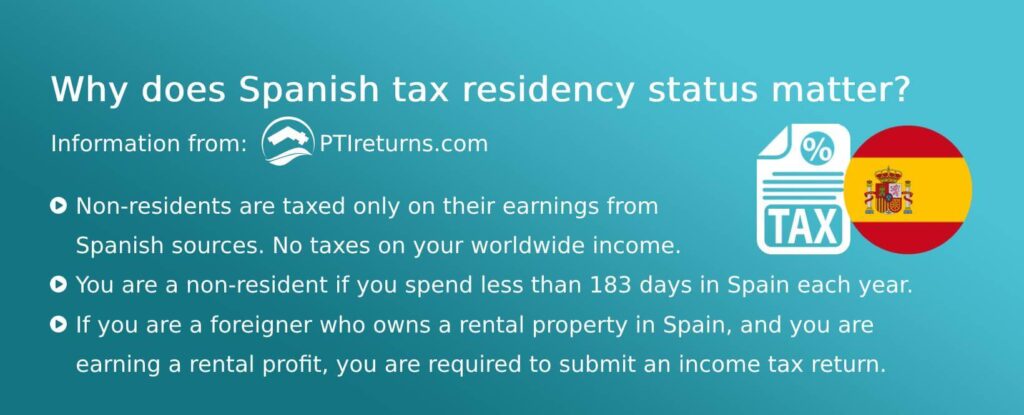

Yes. If you are classified as a resident in Spain, you are required to pay taxes on your worldwide income. However, if you are considered a non-resident, you will only need to pay taxes on any income earned within Spain.

Do non-residents pay Spanish tax on rental income?

Yes, non-resident property owners in Spain are typically subject to Non-Resident Income Tax (Impuesto sobre la Renta de No Residentes) on their rental income.

The tax rate may vary depending on several factors, including the type of property (urban or rural), the amount of income earned, and the country of residence of the property owner.

It’s important to note that Spain has double taxation treaties with many countries, which may affect the tax liability of non-residents.

These treaties can sometimes reduce the tax burden or provide exemptions for certain types of income.

Therefore, it’s crucial to consider both Spanish tax law and any applicable tax treaties when determining your tax obligations.

What is Form 210?

Form 210 is a Spanish tax form used by non-residents who obtain income from sources within Spain.

This income can include earnings from property rentals, business activities, employment, and investments. Non-residents are typically required to file Form 210 to declare their income and pay any applicable taxes.

Spanish tax update 2024: Non-resident landlords can now file rental income annually, submitting one tax return from 1 January to 20 January 2025, for the 2024 period.

Who has to file a Spanish tax return?

If you are a non-resident in Spain and you own property there, you will be liable to several taxes including non-resident income tax in Spain, local property taxes (waste tax and IBI), and probably wealth tax.

EU tax citizens can deduct the allowable expenses. Non-EU citizens cannot deduct the allowable expenses.

If you do not rent your property during the year, you still need to submit an annual tax return (also known as a deemed tax return).

How do non-residents pay their Spanish tax on rental income?

You will have to complete your Spanish property tax return, include the allowable expenses, and submit it to the Spanish tax office or online.

As mentioned above, if you are a resident of the UK for example, you cannot deduct the allowable expenses as you are not an EU tax citizen.

Or you can leave this work to the property tax experts of PTI Returns, and they can do this on your behalf.

What makes you either a resident or a non-resident in Spain?

You are a non-resident in Spain if you live in the country for less than 183 days in a single year. If you are present for more than this, you are considered a resident.

Non-residents pay taxes on any income from Spanish sources while residents in Spain pay taxes on their worldwide income.

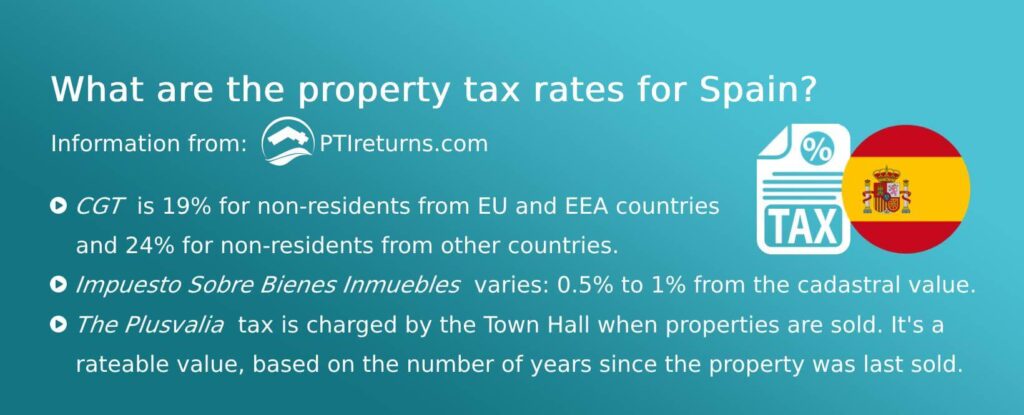

How much is non-resident income tax in Spain?

“Impuesto Sobre la Renta de no Residentes” is a Spanish tax on rental income for non-resident landlords in Spain.

Suppose you rent out your house temporarily. In that case, you can anticipate paying tax on the net income earned at a rate of 19% (for residents in the EU, Norway, and Iceland), after subtracting deductible expenses, or 24% (for non-residents in the EU), with no allowable deductions.

Example:

The taxable base is the net rent. If the annual net rental income is 20,000 Euros and tax is 19% = 3.800 Euro.

How do I benefit from my EU/EEA status?

If you are a resident of an EU country or Norway and Iceland, you can deduct expenses and include depreciation to minimize your tax liability. You simply need to provide a Residency Certificate from the local Tax Authorities and send it to our tax experts. We can take it from there.

What is a Residency Certificate?

A Residency Certificate is a document issued by the appropriate tax authorities of the country of residence, confirming your tax residency in that country. For example, if you are from the UK, you can take it from HMRC. It has a registered address or address of residency for tax purposes.

What deductions can be made to reduce my tax liability?

If you own a rental house, apartment, or office space, you might be able to save on taxes. As mentioned above, EU citizens are entitled to deduct expenses from their net income to reduce their tax liability. A Residency Certificate will be required to deduct expenses.

Examples of Spanish property tax allowable expenses:

Note: The expenses are pro-rated as per the number of days the property is rented, except bank charges, management & letting agent fees.

- Mortgage Interest (excluding capital element which is not allowable)

- Bank charges

- Local rates

- Management fees

- Letting agent fees

- IBI local tax

- Waste local tax

- Insurance

- Running costs

- Cleaning

- Maintenance and improvement costs

- Building and Furniture depreciation /Capital allowances/

If there is no residency certificate enclosed along with the tax return, no expense deductions can be made in favor of the landlord.

How much Spanish income tax do I owe if I do not rent out my property in Spain?

Foreigners may not be aware that they must pay non-resident income tax in Spain even if they do not rent out their property.

This tax is called Impuesto de la renta de no residentes, declaración ordinaria (IRNR). It is also known as Deemed tax (Imputed tax).

You will have to pay this non-resident income tax in Spain if you:

- don’t live in Spain

- have an urban Spanish property

- don’t rent out this real estate, it’s exclusively for personal use

- don’t have any other taxable income in Spain

You will have to use the general section in Form 210 IRNR (Non-resident income tax in Spain) and select income type 02.

Imputed income is 1.1% of the “valor catastral” (cadastral value of the property) or 2% if no re-valuation has occurred in the previous ten taxable periods.

After calculating the imputed income, you must determine the tax due by applying the non-resident tax rate.

The tax rate for residents in the EU, Norway, and Iceland is 19%. For non-residents of the EU, the tax rate is 24%.

Example:

If the cadastral value of the property is 200.000 Euros and the taxable base is 2.200 Euro (1.1% as mentioned above). In this situation, if you are a resident in the EU, tax = 19% X 2.200 Euro = 418 Euro.

When do I need to file my tax return and pay the Spanish tax on rental income?

If you do not have rental income, only one annual deemed tax return has to be submitted. The deadline is 31 December following the end of each tax year.

Starting in 2024, you must report your rental income once a year instead of quarterly.

For income earned in 2024, you will have to submit your Spanish rental income tax return between January 1 and January 20, 2025.

This annual reporting replaces the previous requirement to file quarterly income tax returns. However, for income earned in tax years before 2024, you can still submit quarterly income tax returns.

It is also possible for EU residents to submit a ‘total year’ tax return if they have made a loss or have not generated any income during the quarter.

Note: If the real estate is rented for 200 days, for example, a deemed tax return must be filed for the rest of 165 days in addition to the quarterly rental property income tax returns.

Got questions? You can request a no-obligation call with a property tax advisor.

What happens if you miss a previous tax filing deadline?

Paying tax on rental property in Spain is mandatory. If you miss a filing and payment deadline you may incur fines or penalties, as below.

| Up to 3 months | 5% |

| Up to 6 months | 10% |

| Up to 12 months | 15% |

Why PTI Returns?

#1 We provide a first-class tax service with trusted tax experts

#2 Our service is fast and reliable. We remove the hassle, uncertainty, and time associated with arranging your tax affairs in Spain

#3 We offer property tax preparation for Spain

#4 PTI Returns is part of CluneTech (formerly known as Taxback Group), employing over 1,500 people in more than 20 countries worldwide.

Why PTI Returns is better than a local accountant?

Here are some reasons why our clients owning Spanish real estate choose PTI Returns instead of local Spanish accountants:

- Better value – we offer a more affordable service than your local accountant

- One-stop shop – need to file tax documents in more than one jurisdiction? You can do it all online with PTI Returns! This is one of the most unique things that sets us apart from most accounting services

- Tax specialists – We know Spanish property tax! We guarantee to properly determine your residency status and apply every tax relief you’re entitled to

- No language barrier – we speak our client’s language and communicate with the local tax authorities on their behalf, ensuring their forms are filed correctly

- Local knowledge – we have offices all over the world. This enables us to have substantial local knowledge in every country and help you to maximize your investment profit potential

Want to learn about our tax return filing service?

When you apply through this contact form a PTI Returns tax specialist will contact you.

Read also:

UK Resident selling property in Spain – Everything you need to know

2024 Guide to rental income tax in Germany

Foreign rental income tax – A guide for American investors with overseas property