Last Updated on January 10, 2025

In the ever-changing world of property ownership, knowing the ins and outs of rental income tax is a must for UK landlords.

While the tax system may seem like a maze, having the right information puts you in control, ensuring you follow the rules and make the most of your finances.

Discover the intricacies of rental income tax in the UK through our comprehensive guide.

In this guide:

- What is considered UK rental income?

- How much tax will I pay on my rental income?

- What are the rental income tax rates in the UK?

- How do I lower my rental taxes in the UK?

- What are allowable expenses for rental income?

- What expenses for rental income are not deductible?

- What allowances and tax reliefs are available for UK rental income?

- What is the Non-Resident Landlord Scheme (NRLS)?

- Am I considered a non-resident landlord for the NRLS?

- What obligations do I have as a non-resident landlord, under the NRLS?

- What are the different types of property ownership, and how does each type impact taxes?

- What is the income tax from several properties in the UK?

- How can I declare a loss on rental income?

- Should I pay UK rental income tax on income from a property abroad?

- When do I have to pay National Insurance on rental income in the UK?

- Is it rental income or trading income?

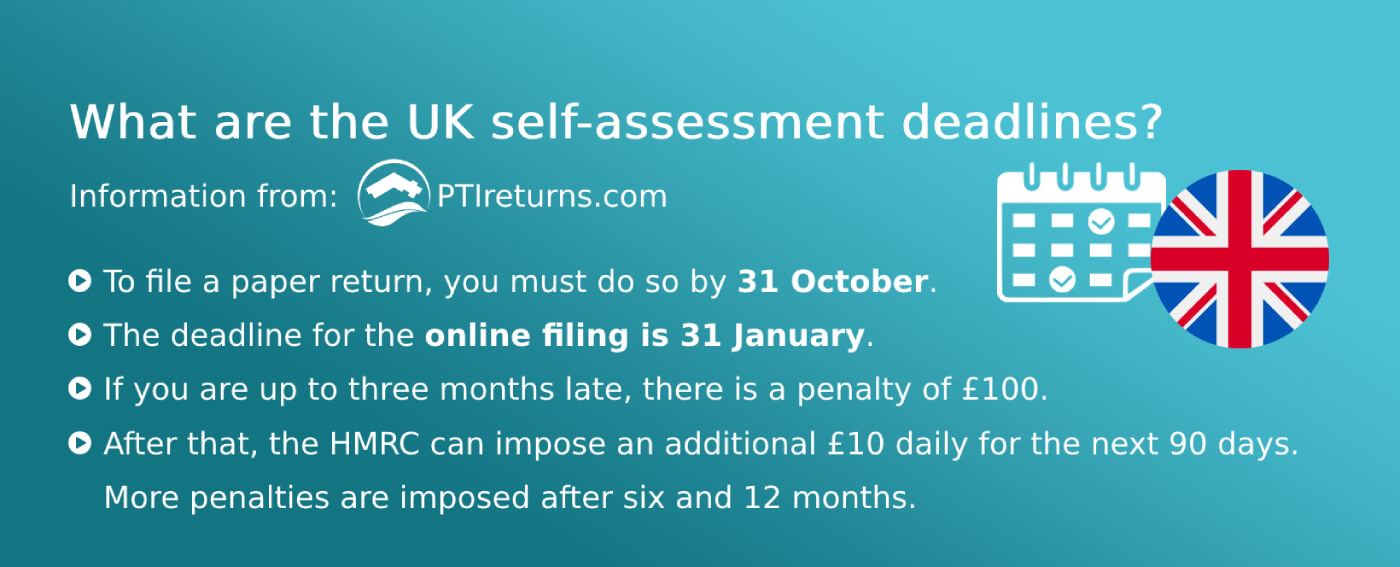

- When is the UK tax deadline?

- What happens if I miss the tax deadline in the UK?

- Who can help me file my UK rental tax return online?

What is considered rental income?

UK rental income is classified as any money you receive from your tenants for:

-

- Rent (This includes money you make from renting out a flat, house, or even just part of them, like a room or a parking space)

-

- Payments for services, such as utilities

-

- Cleaning of public areas or gardening

-

- Insurance payments received from tenants

-

- Any other payments received in connection with the letting of the property

If you collect non-refundable deposits or keep extra money from a returnable deposit, these count as part of your rental income.

You can subtract the costs you have from letting the property.

Plus, you can get a tax credit for 20% of your mortgage interest payments.

How much tax will I pay on my rental income?

As a landlord, you typically need to pay income tax on the profit generated from your rental properties.

In simple terms, your profit is what remains after combining your rental income and subtracting any expenses or allowances.

Your rental profits are taxed at rates similar to what you’d pay on your job or business income.

These rates can be 0%, 20%, 40%, or 45%, and the specific rate depends on how much money you earn.

What are the rental income tax rates in the UK?

To determine your tax bracket you will need to subtract any applicable allowances or expenses.

If your revenue is below the basic rate threshold of £12,570, you won’t have to pay any tax.

The Income Tax rates in the UK for 2024 are (including Scotland):

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of £12,570.

| BAND | TAXABLE INCOME | TAX RATE |

| PERSONAL ALLOWANCE | Up to £12,570 | 0% |

| BASIC RATE | £12,571 to £50,270 | 20% |

| HIGHER RATE | £50,271 to £125,140 | 40% |

| ADDITIONAL RATE | over £125,140 | 45% |

How do I lower my rental income tax?

To lower your it, make sure to:

- claim allowable expenses

- use the annual personal allowance

- explore capital allowances

- consider the Rent a Room Scheme if applicable

- think about incorporating as a limited company

- offset mortgage interest wisely

- stay informed on tax changes

Got questions? Request a free callback from a tax expert.

What are the allowable expenses?

When you pay landlord taxes, you can gain advantages through allowable expenses and deductions.

These expenses should be exclusively for renting out your property and can be subtracted from your taxable profit.

Additionally, property owners can deduct mortgage interest if they’ve purchased a non-residential property for letting.

Here are allowable expenses you can subtract if you pay for them:

- Fixing and maintaining the property

- Utility bills like water, gas, light, heating costs and electricity

- Council tax

- Insurance, like policies for the building, contents, and public liability

- Service costs, including wages for gardeners and cleaners (cleaning costs)

- Fees from letting agents and property management

- Legal fees for short-term leases or renewing a lease for less than 50 years

- Accounting fees

- Rents, ground rents, and service charges

- Direct costs like phone calls, stationery, and advertising for finding new tenants

- Vehicle running costs, but only the part used for your rental business, including mileage deductions for business motoring costs

⚠️ Several changes have been made to the way you can deduct mortgage costs from rental income.

Rental Income Tax

What expenses for rental income are not deductible?

- Your full mortgage payment

- Mortgage interest

- Phone calls, which are not related to your property rental business

- Personal expenses not related to your property rental business

- Clothing

- Renovations or home improvements

Maintaining meticulous records of rental income and associated expenses is crucial for landlords when paying tax on rental income in the UK.

What allowances and tax reliefs are available for UK rental income?

In the UK, several tax reliefs and allowances are available for rental income from property.

Here are some key ones:

● Rent a Room Relief:

The Rent a Room Scheme allows you to make up to £7,500 a year tax-free by renting out a furnished room in your home. If you share this income with someone, the limit is halved.

You’re free to rent out as much of your home as you want.

That’s how it works:

If you earn less than £7,500, you’re automatically exempt from tax, and you don’t have to do anything. If you earn more, you need to complete a UK property tax return.

You can then choose to join the scheme and get your tax-free allowance by doing it on your tax return. If you prefer, you can skip the scheme and just report your income and expenses on the property pages of your property tax return.

Here is the Rent a Room Scheme eligibility.

You can join the scheme anytime if:

- You’re a landlord living in the same place, whether you own it or not

- You’re in charge of a bed and breakfast or a guest house

But, you can’t use this scheme for homes that have been turned into separate flats.

Got questions? Request a free callback from a tax expert.

● Furnished Holiday Lettings:

If you let out a property on a short-term, usually seasonal basis, specifically to tourists and visitors, there are special rules for furnished holiday lettings.

● Property Allowance:

Individuals who receive property income can benefit from a property allowance of £1,000. This means that the first £1,000 of property income is tax-free.

There is no need for any additional action on your part, this exemption will be applied automatically.

Imagine you make £12,000 from various sources, and you also earn £1,000 from renting out property. Thanks to the property allowance, you don’t have to add the £1,000 earned to your overall income.

Since the total remains below the personal exemption limit in the UK, you won’t have to pay any taxes on it.

● Buy-to-let tax relief:

Buy-to-let tax relief in the UK refers to the deductions landlords can claim on their mortgage interest payments to reduce their taxable rental income.

Starting in April 2020, every buy-to-let landlord get a tax credit equal to 20% of what they pay in mortgage interest.

For instance, if you made £15,000 from renting and are in the 20% tax group, your tax bill would be 20% of £15,000, which is £3,000.

Let’s say your annual mortgage interest adds up to £10,000. The good news is, you can get a tax break of £2,000 (which is 20% of £10,000).

Now, subtract this tax break from your tax bill:

£3,000 – £2,000 = £1,000 is what you owe to HMRC.

Certain landlords may qualify for specific tax reliefs or exemptions when paying tax on rental income in the UK.

Read also:

Top tax advice for foreigners who own property in the UK

UK Rental Income Tax

What is the Non-Resident Landlord Scheme?

The Non-Resident Landlord Scheme (NRLS) is a scheme to tax the UK rental income of landlords who have a usual place of abode outside the UK – known as non-resident landlords.

To comprehend the NRLS, it is necessary to realize that if you live abroad but receive income from letting out a property in the UK, this income is typically taxable in the UK, just like any other income derived from a property in the UK.

This is true regardless of whether you are a resident or non-resident of the United Kingdom for tax reasons.

Under the NRLS, the law aims to collect tax before it is paid to the overseas landlord.

The tax year runs from 1 April to 31 March for the NRLS.

The NRLS imposes duties on the rental agent (if there is one) or the tenant. The letting agent is required to withhold income tax before it is paid to the foreign landlord.

If there is no UK rental agent, the renter must withhold tax personally if the rent paid to the overseas landlord exceeds £100 per week.

Any tax withheld by the letting agent or tenant is subsequently deducted from the foreign landlord’s UK tax liability when they file a UK self-assessment tax return.

⚠️ Even if there is no tax to pay, non-resident landlords are usually required to file a self-assessment tax return.

Form NRL6 is issued to the landlord as evidence of tax remitted to the HMRC.

If the landlord wants to receive their rent without any deduction, he or she must complete a Form NRL1, and submit the same to HMRC for approval.

These forms may require information about the property and letting agent.

Am I considered a non-resident landlord for the NRLS?

It is critical to understand that being a non-resident landlord for the NRLS is not the same as being a non-resident landlord for UK tax purposes.

⚠️ It is possible to be considered a non-resident landlord for the NRLS while being a UK resident for tax purposes, which can be confusing.

If you have rental income in the UK and a usual place of abode outside the country, you will be treated as a “non-resident landlord” for the “non-resident landlord scheme.”

The good news is that if you have questions, the property tax experts at PTI Returns are ready to answer them.

What obligations do I have as a non-resident landlord, under the NRLS?

The NRLS does not impose any specific obligations on non-resident landlords.

On the other hand, if you have income from real estate, you will typically be required to file a self-assessment tax return on rental income, on which you should subtract any NRLS tax paid from your UK tax obligations.